WoodMac: Vestas Tops Global Wind Turbine Supplier Rankings in 2019

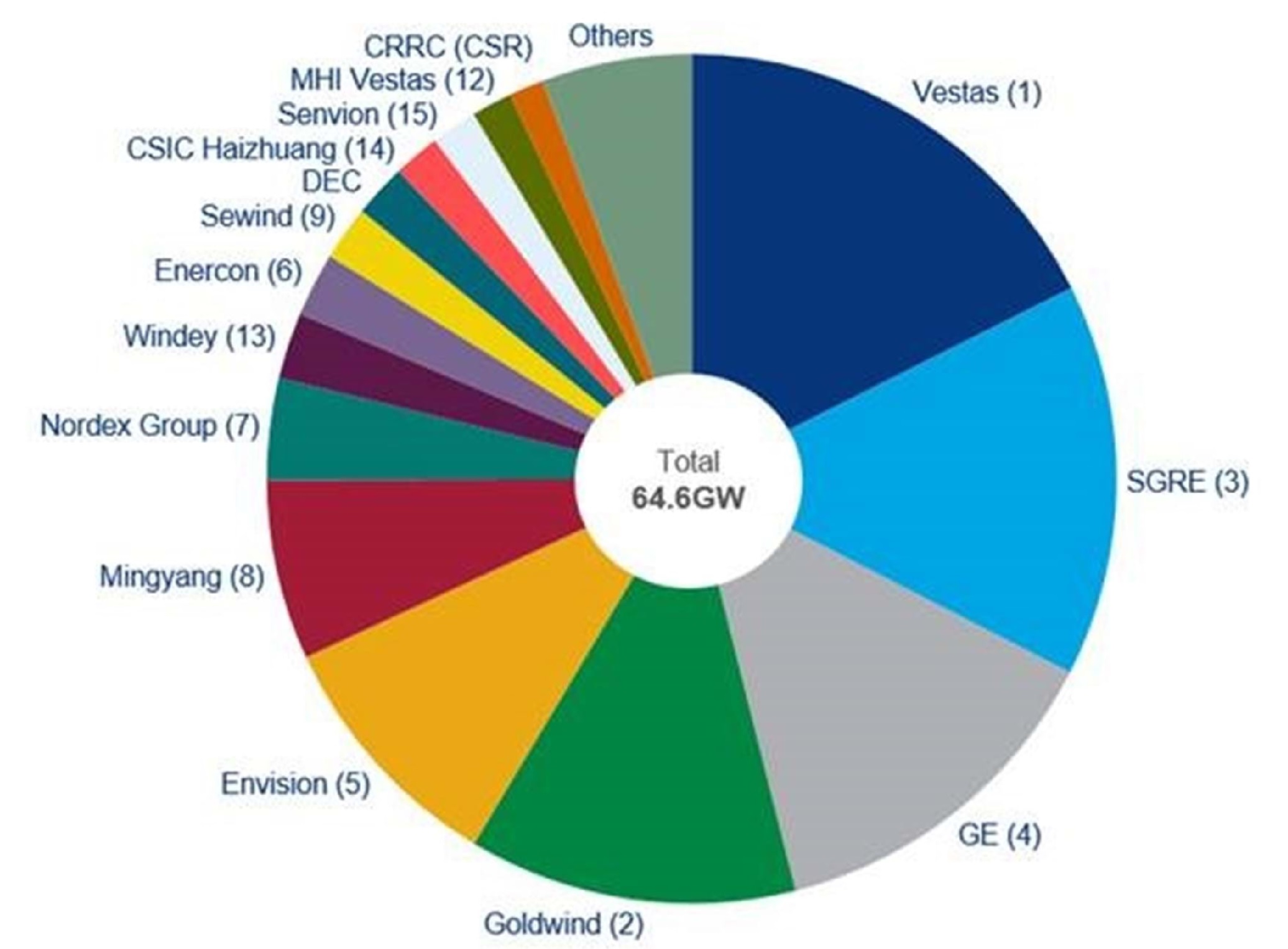

Vestas, Siemens Gamesa and General Electric were the largest suppliers last year in the consolidating global market for wind turbines, according to new figures from Wood Mackenzie.

All three companies put up record installations in a global market expected to be worth $600 billion over the course of the 2019-2028 period.

Denmark’s Vestas held onto its position as the world’s leading wind turbine supplier thanks to its enduring strength in the onshore arena, with an especially strong performance in the booming U.S. market.

While its lead over No. 2 supplier Siemens Gamesa Renewable Energy shrank modestly in 2019, Vestas nevertheless grew its total installations and became the first wind turbine manufacturer to grid-connect more than 10 gigawatts in a single year, putting up 11.3 gigawatts. The world built around 65 gigawatts’ worth of new wind farms last year.

Siemens Gamesa grew its share of the global market as it continues to dominate the market outside of China for offshore wind turbines. Germany’s Siemens, which owns the largest share of Siemens Gamesa, plans to merge the wind turbine maker with its broader power and grids business and spin it off as a separate company later this year, to be called Siemens Energy.

Global wind turbine suppliers by 2019 market share. Credit: Wood Mackenzie Power & Renewables

While the top three positions in WoodMac’s ranking were held by Western companies, the immensity of China’s wind market allowed three Chinese suppliers to claim the next three spots: Goldwind, Envision and Mingyang.

Unlike the solar industry, China’s wind turbine manufacturers have largely failed to break out of their home market, with just 600 megawatts of Chinese turbines exported last year. Goldwind, China’s most important wind company on the global stage, is currently delivering turbines through the Port of Vancouver to a 200-megawatt project in the Canadian prairies, a potentially significant breakthrough for the company in the North American market.

Big get bigger in global wind market

Amid a growing global wind market — expected by WoodMac to average around 77 gigawatts of new annual installations during the 2020s — the number of major turbine makers is on the decline.

“Smaller regional players, including Senvion, Suzlon, Inox, XEMC and WEG, lost market share due to challenging market conditions,” said Shashi Barla, principal analyst at Wood Mackenzie. “This resulted in financial difficulties that will jeopardize their future participation in the wind sector.”

Rounding out the top 10 list of leading wind turbine suppliers in 2019 were Nordex (Germany), Windey (China), Enercon (Germany) and Sewind (China).

Despite the coronavirus pandemic, which has led to temporary factory closures, logistical bottlenecks and financial losses at the industry’s major manufacturers (including Vestas and SGRE), WoodMac expects only a modest hit to the global market this year — having previously shaved 4.9 gigawatts off its previous forecast for the 2020 market.

That leaves the global market on track for 73 gigawatts of total installations in 2019, a significant step up from last year as China and the U.S. remain on track to add record volumes this year.