The long read: Cheaper, safer EV batteries to bolster grid

Electric vehicles can transition from liabilities to assets if steps are taken by battery manufacturers, the auto industry, and policymakers, argues Milan Rosina, a principal analyst in the power electronics and batteries division of Yole Développement.

From pv magazine 05/2020

Total annual demand for battery packs will grow from 111.7 GWh in 2019 to 852.5 GWh by 2025 – a seven-fold increase. Battery electric vehicles (BEVs), including plug-in hybrids (PHEVs), together will account for 75.9 % of total GWh demand by 2025. Despite strong demand for stationary batteries, especially those associated with intermittent renewables, the stationary battery market remains small compared to BEVs/PHEVs.

As governments have set aggressive targets to reduce CO2 emissions from passenger cars, automakers focus increasingly on “strong vehicle electrification”: PHEV and BEV. This accelerated transition has interesting consequences. The number of EVs on the road is growing, and the average battery capacity per vehicle is increasing to enable longer range. This results in a huge battery demand to manufacture the vehicles, but also in large amounts of battery energy storage capacity present in the EV fleet.

Internet of Energy

Equally large amounts of energy will be required to charge of all these vehicles, and it may result in grid instability – the grid might not be able to provide enough power for charging, especially during peak hours in some regions. But the huge amount of energy storage capability in BEVs and PHEVs can have a positive impact as these batteries become a part of the global energy ecosystem – the “Internet of Energy”, where electricity generation, transmission and distribution, storage, and consumption are strongly interlinked. A smart interlinking of different parts of this ecosystem can minimize their drawbacks and, thanks to their synergies, increase their added value.

To avoid grid instability and enable higher penetration of wind and PV, a buffer solution is highly desirable. Stationary energy storage is increasingly being used for this purpose. EV charging can create electricity demand peaks when many car owners decide to charge their vehicles at the same time. A smart solution is required to match peak generation periods with EV charging. This would lower the need for additional energy storage systems and thus reduce both costs and environmental impacts of the whole system.

Moreover, in the future, bi-directional chargers can enable energy stored in a vehicle to power appliances in a home, known as vehicle-to-home (V2H). These EV batteries can also support grid stability, the vehicle-to-grid (V2G) approach, if used for large vehicle fleets. Indeed, the energy stored in an EV battery is rather significant. Individual battery capacity has surpassed 15 kWh for some PHEVs and approaches 100 kWh for high-end BEVs. The PHEV/BEV battery capacity can thus be much larger when compared to some residential stationary batteries. However, to deploy interlinked solutions on a large scale, several issues must be solved.

An appropriate business model has to be found for electricity providers, which has to put in place variable electricity pricing for customers to motivate them to charge during the periods when surplus electricity is generated.

The cost of EVs also has to be reduced. Most efforts are focused on the reduction of battery cells and other components such as thermal management and safety devices. The battery remains the most expensive component of an EV. Yet, at end of life, it can retain 70% to 80% of its initial capacity. Therefore, major car manufacturers have partnered with energy storage companies to use such batteries for second-life applications.

The safety of battery packs also has to be improved, either at the cell or at the pack level, through more uniform temperature distribution, better cooling, enhanced battery management systems, and faster-acting current circuit breakers and fuses.

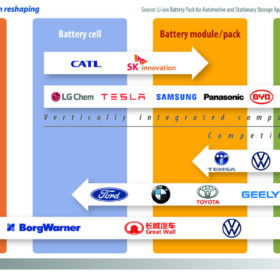

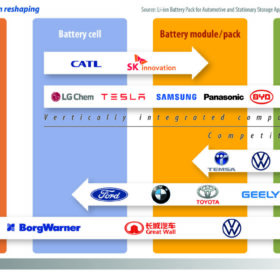

Most system integrators design and manufacture battery packs in-house. Carmakers, however, are becoming increasingly intrusive in this area (see diagram on previous page).

About the author

Milan Rosina is an analyst for Yole Développement’s power electronics and batteries division. He is engaged in the development of the market, and conducts technologic and strategic research on innovative materials, devices and systems. His main areas of interest are EV/HEV, renewable energy, power electronic packaging, and batteries. He has 20 years of scientific, industrial and managerial experience involving equipment and process development, due diligence, technology, and market surveys in the fields of renewable energy, EV/HEV, energy storage, batteries, power electronics, thermal management, and innovative materials and devices.