Residential Demand Response to Play Key Role Managing US Load This Summer

Heading into summer 2020, looming uncertainty about electricity demand makes flexibility more vital than ever in the United States.

In particular, residential demand response faces more pressure than usual, as many people continue to work from home over the next few months.

Since the economy’s reopening will be gradual, grid operators need not be too concerned that system peak demand will make demand response events necessary. However, some residential-only distribution feeders may face increasing pressure as air conditioning load rises.

Already, some vendors providing customer engagement, analytics and demand response services for residential programs are seeing an increasing need to accelerate demand response targets in some service territories.

Time for residential demand response providers to shine

The number and diversity of companies that fall into this category is larger than ever.

In California, the number of third-party demand response providers registered with the California Public Utilities Commission, has tripled since 2016. Some of those are more traditional C&I aggregators such as CPower, Enel X, and Voltus, but others are focused on the residential space.

The residential aggregators that could be in a position to help bring flexible capacity to market this summer include Autogrid, Ohmconnect, Chai Energy, EnergyHub and SunRun, as well as newer entities such as Leap, which are bringing a platform provider approach to demand response aggregation.

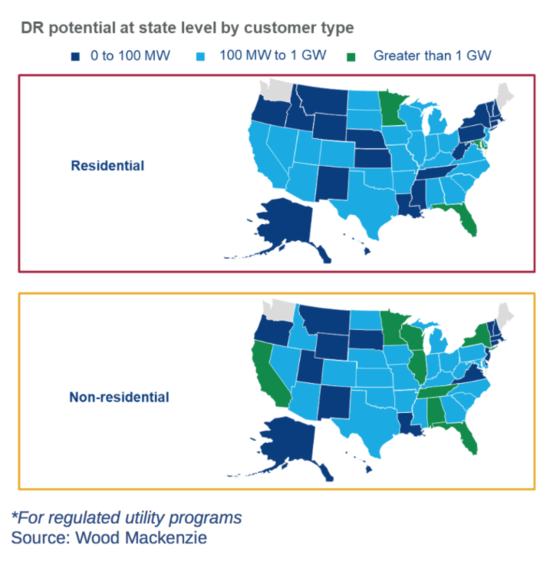

In regulated utility programs, WoodMac’s latest data indicates there are more than 10 gigawatts of available residential demand response in the US power system.

(Additional figures from the report are aviailable via Wood Mackenzie here.)

WoodMac has seen that residential demand response can contribute hundreds of megawatts of relief at a local level while stacking value from the wholesale market, as it did for PJM in the summer and shoulder moths of 2019.

In that example, the RTO utilized a maximum of 655 megawatts of capacity in economic programs in July 2019 in the Baltimore Gas and Electric (BGE) territory. All available demand response in the BGE territory is residential capacity from both behavioral and direct load control programs.

Out of the summer season, during its first emergency event since 2014, in October 2019 the RTO called on 240 megawatts of demand response for availability from BGE.

As state economies open up at different time scales across the PJM’s multi state footprint, residential demand response flexibility will remain a valuable resource in the summer 2020 and into the shoulder months for the RTO and likely all grid operators across the US.

The role of generators

One flexibility resource that may play a particularly important role this summer: natural gas and diesel back-up generators.

18 percent of confirmed wholesale market demand response registered capacity in the United States comes from behind-the-meter diesel and natural gas generators, according to WoodMac.

Going into summer 2020, these generators are expected remain available despite uncertainty around demand, because they can be operated irrespective of the load on a customer site.

In total, ISOs and RTO’s can tap into nearly 6 gigawatts of behind-the-meter generation this summer. MISO has over 4 gigawatts of behind-the-meter generator capacity it can tap into across its multi-state footprint while PJM has nearly 1 gigawatts at its disposal for emergency curtailment events.

DR provider data can help with load predictions in summer 2020

DR providers may have access to load data points that utilities don’t have access to, especially when utilities don’t have AMI. Commercial and industrial DR providers often have real-time metering on site, even in utility territories where there is a lack of smart metering deployment.

Thus, demand response partners can assist utilities with load forecasting for these facilities, in order to better monitor grid needs.

This summer, the grid will need to count on residential demand response in both emergency and economic dispatches. Even as the economy gradually re-opens, people who can work from home are expected to continue to do so, leading to higher pressure on distribution infrastructure serving residential-heavy territories in summer 2020.

As distribution load becomes harder to predict due to the pandemic, targeted residential demand response may bring much needed relief, making these months leading up to the peak summer critical for customer segmentation and targeting for various utility programs across the country.

Utility demand response and operations teams typically function in silos, separated by residential and non-residential programs. In summer 2020, they may start working together more closely in order to address system-level and locational needs.

***

Elta Kolo is Grid Edge Content Lead at Wood Mackenzie. Fei Wang is Grid Edge Research Manager. Download sample figures from two recent report focused on demand response/DER aggregation here.